How Collection Agency Merchant Accounts changing the payment method?

Although it is currently easy to transfer money across the continents quickly, it wasn’t always so. Our ancestors didn’t have access to the internet, which means that they had to carry money with them when they travelled to distant lands. Unfortunately, many of the popular routes were usually observed by the robbers. It still happens in some countries, but usually, the travellers don’t have to fear that all their savings will be stolen. That’s because most of us don’t carry physical money. Instead, our money is safe on our bank accounts. This way, if you are a particularly rich person, you don’t have to bring with you huge bags full of cash.

Without plastic money, the growth of e-commerce wouldn’t be possible. Nowadays, you don’t even have to leave your room to order groceries, clothes, or food for your pet. All of it can be done using the internet. It is true that some of the channels that are being used could be threatened by people with bad intentions, such as hackers. Still, the security of such systems is usually incredibly difficult to crack.

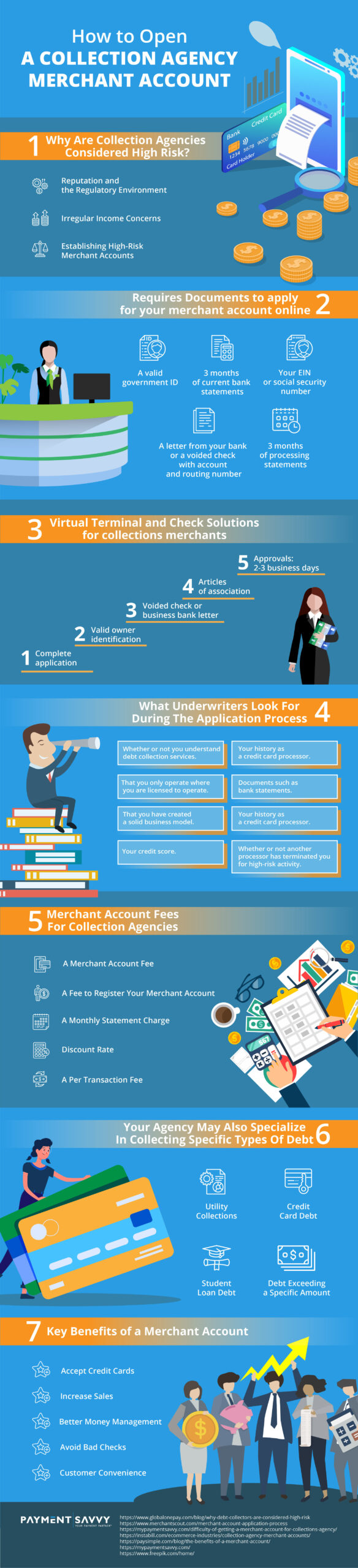

It doesn’t mean that there aren’t other types of problems with plastic money. Nowadays, it is difficult to run a business without partnering with a payment processing company. Unfortunately, not all types of businesses are equal in the eyes of payment processing companies. Businesses that deal with debt collections deal with clients who are considered to be somewhat “shady”. As an effect, the contracts that those businesses sign with payment processing companies are usually one-sided. Still, despite this fact, it is impossible to run a business in 2020 without enabling your clients to pay with credit cards instead of cash. You can check out this infographic provided by MyPaymentSavvy if you want to learn more about collection agency merchant accounts.