Yoyo partners with Mastercard to bring Pay by Bank app to the High Street

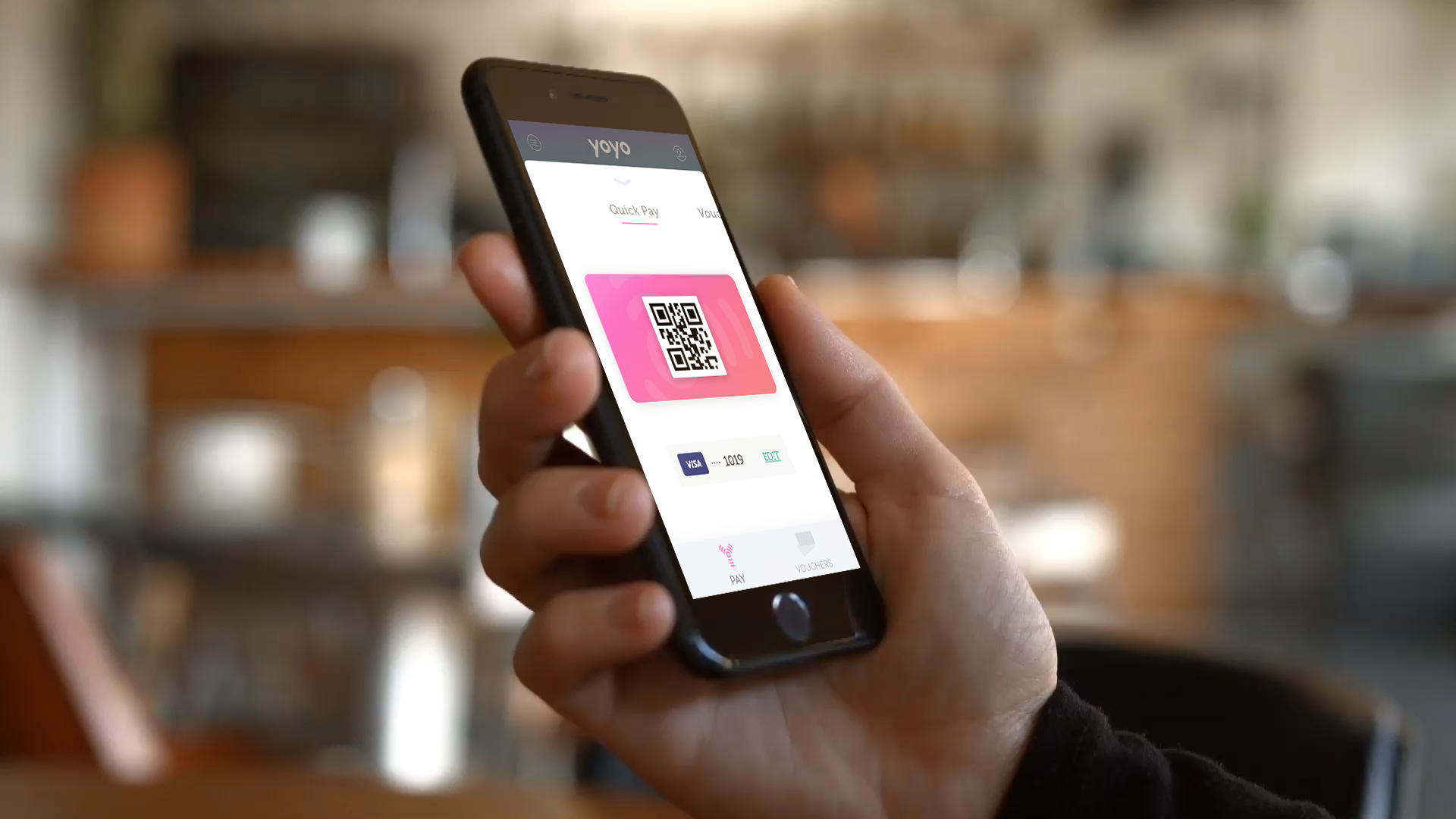

Mastercard’s unique mobile payments service ‘Pay by Bank app’ has entered into a strategic partnership with payments, marketing and loyalty commerce platform Yoyo to deliver the most secure, fast and personally rewarding payments experience to its customers.

? Mastercard-owned Pay by Bank app can be used on the high street for the first time

? Users will see super-enhanced security and fast payment, whilst automatically

receiving retailer specific loyalty, personalised rewards, offers and digital itemised receipts at the point-of-sale when using Pay by Bank app

Under the partnership, Yoyo and Pay by Bank app (PbBa) – a new way to pay – will deliver a combined payments and customer loyalty offering to retail and bank customers in 2019.

Initially available for in-app purchases with Yoyo retailers, for the first time users will be able to use PbBa in physical stores – with customers automatically collecting retail-specific loyalty and digital receipts, as well as rewards, offers and surprise and delight campaigns tailored to their habits and shopping preferences.

Created by Mastercard’s Vocalink business, Pay by Bank app is a new, easy and secure way for customers to pay from their bank account using their trusted mobile banking app, without the need to enter any additional details or passwords It is designed to simplify the checkout experience giving customers more control when they make a purchase.

One of Europe’s fastest-growing fintech companies, Yoyo’s unique commerce API enables its banking and retail partners to instantly combine payment with personalised loyalty, campaigns, rewards and offers, as well as delivering fully-itemised digital receipts to more than 1.5 million users by identifying purchase and product preference behaviour through the point-of-sale. APIs are growing to be part of most businesses. The eCommerce sector is booming with the availability of cloud-based commerce platforms like Commercetools that provide APIs to power sales and payment online. Implementing such software isn’t difficult because commercetools partner (like Royal Cyber) or whichever API the business opts for, there are IT services that can support any growing business with their digital transformation.

Banks and retailers will now have access to an unparalleled level of anonymised payment and basket data through the Yoyo platform, enabling a new level of understanding, engagement and personalised marketing, whilst at the same time ensuring that individual identity and payment data is fully protected through Yoyo’s unique double tokenization technology and the bank grade security offered through Pay by Bank app. Retailers of all kinds should be able to integrate the Yoyo platform and work with it alongside their existing POS software/hardware (similar to POSaBIT Unlimited POS for cannabis dispensaries) that allows a host of different customizable options for accepting payments. The provision of integrated payments along with instant access to loyalty programs and other perks makes for a smoother experience and leaves both customers as well as business owners happier in the process.

Yoyo CEO Michael Rolph said: “We’re delighted to be working with Mastercard and Pay by Bank app. We’ve always believed that adding both security and value to the payments process is crucial for the future of bricks and mortar retail, and this partnership is going to significantly enhance the customer experience for PbBa users.”

“The combined Yoyo and Pay by Bank app proposition will provide both customers and retailers with added speed and security at the point-of-sale, as well as an omnichannel payment and loyalty experience that is unrivalled in the market.”

Jonathan Wood, Senior Vice President, Consumer Applications at Mastercard said: “Pay by Bank app is set to shape the future of payments, as more banks and retailers offer this as an option to shoppers. We are thrilled to be partnering with YoYo to bring this revolutionary new way to pay to the High Street, putting the customer firmly in control of their finances. We are committed to transforming the payments landscape with this fast, secure and convenient new way to pay.”